If you are a brand owner or manager, you must already be familiar with the fact that retaining an existing customer is easier than acquiring a new one. In fact, the probability of selling to an existing customer is between 60% to 70%, whereas the probability of selling to a new prospect is only 5% to 20%.

Although customers are gained and lost over a brand’s lifetime, a truly excellent product/service accompanied by valuable customer service can keep customers satisfied and hungry for more. This appetite for “more” keeps customers returning and adds value to the brand's relationship with consumers.

The last thing any business wants for its customers is to churn while they continue to scramble for new revenue streams. The best way to mitigate this crisis is by monitoring customer lifetime value (CLV).

When brands measure customer lifetime value, they can retain highly valuable customers and calculate how much they are worth over the customer's lifetime. This ultimate guide teaches how to increase CLV and tips to measure customer lifetime value.

What is customer lifetime value?

Increasing the value of your existing customers is an excellent strategy to foster growth since retaining existing customers is less expensive than attracting new ones.

Customer lifetime value (CLV, or CLTV) is a metric that shows how much money a brand can expect to make from a single customer account throughout the customer relationship. A customer's lifetime value increases the longer they remain a loyal customer of the business.

When measuring a customer's lifetime value, you must also consider customer acquisition costs (CAC), marketing expenditures, operating costs, and the cost to produce the goods and services the business sells.

Many businesses choose a short-sighted strategy and focus on acquisition, ignoring this essential measure. While attracting new clients is crucial for business expansion, companies must also maximize the lifetime value of their current clientele to maintain a sustainable business model.

Customer support and sales teams directly influence the customer lifetime journey of an end user. Therefore, they play a crucial role in making informed decisions, solving problems, and offering recommendations that increase customer loyalty and reduce churn rates.

Profits can rise anywhere from 25% to 95% with just a 5% increase in client retention rates. In light of this, brands must design a customer retention strategy and monitor its success by measuring the customer's lifetime value.

Why is it important to measure the customer's lifetime value?

Customer lifetime value (CLV) can be used to make essential business decisions. For instance, you can use customer lifetime value to determine which customer categories are most beneficial to the business and then target them appropriately.

When you have a multi-year engagement with a consumer, such as a paid TV subscription or mobile phone contract, CLV is a great indicator of future revenue stream. It is also helpful in identifying the earliest signs of attrition when spending starts to decline after the first year due to declining subscription renewals.

Here are a few more reasons why it is necessary to measure customer lifetime value:

1. It helps you improve your business strategy

Once brands evaluate the customer lifetime value they can break it down into different factors, i.e. different sources of revenue, and start designing their business strategy to leverage the main sources of revenue while reducing costs. In short, it helps you improve your business strategy.

2. It helps you target the right group of customers.

Knowing a customer's lifetime value allows you to estimate how much they will spend with you over time, whether it be $50, $500, or $5,000. With such information, you can create a customer acquisition plan focusing on clients who will spend the most money with your company.

3. It allows you to make better decisions concerning customer acquisition costs

Knowing what you can expect to make from a typical customer allows brands to adjust spending to boost or decrease profitability and maintain the right customers.

4. It leads to improved forecasting

CLV predictions support a brand’s ability to plan for inventory, personnel, manufacturing capacity, and other costs. Without a prediction, you run the risk of unintentionally overspending, wasting money or underspending, and struggling to meet your customers’ demands.

5. It drives repeat sales

Some types of businesses have a devoted clientele that keeps coming back. The average number of visits per year or over the client's lifetime can be tracked using CLV, and brands can use that information to plan tactics to boost recurring business.

Preventing client attrition and enhancing customer retention are two of the most significant aspects of managing CLV. You can find out your best customers and what's working well for them by tracking these facts and accurately segmenting your audience.

6. It boosts the profitability of the business

In general, a higher CLV should result in greater profits. Brands should see the benefit of their bottom line as a result of keeping consumers for longer and creating a business that encourages them to spend more money consistently.

As we discussed, measuring CLV can assist a brand in striking a balance between its short- and long-term marketing and sales objectives and show that you have a better grasp of the financial return on your efforts. Additionally, CLV teaches marketers to spend less time gaining clients creating low value, which promotes better decision-making.

The most obvious benefit of customer lifetime value is the efficient management of your customer relationships, which boosts profitability.

How to measure the lifetime value of your customers

Calculating CLV can be challenging if the brand's customer relationship measures are not in place. However, an enterprise resource planning (ERP) or customer relationship management (CRM) system can quickly make this information accessible on an automated dashboard that monitors KPIs.

CLV can be determined at three different levels:

The company level

(i.e., the average CLV across all your customers).

The customer segment level

(i.e., the CLV of various subgroups within your customer base).

The individual level

(the CLV of each customer you deal with).

This guide will discuss tips for measuring customer lifetime value for the entire organization. There are a few crucial pieces of information you will need on hand before diving right into the CLV formula.

Average purchase value is the sum of all customer purchases made over a specific period (typically, a year is the simplest), divided by the total number of purchases made during that time. Average purchase frequency is calculated by dividing the number of transactions made during the same period by the total number of consumers who transacted during that time. Customer value is calculated by multiplying the average purchase frequency by the average purchase value. Average customer lifespan is the typical number of years a customer stays a customer of yours.

Calculating CLV is pretty easy now that you have all the necessary information. The formula for calculating the customer lifetime value is:

Therefore, calculating the average purchase value and multiplying it by the average number of purchases will give you the CLV. The average customer lifespan can then be multiplied by customer value to get the average customer lifetime value.

There are two ways to measure the lifetime value of your companies that companies can use to get accurate results. However, the two models can result in different outcomes. It depends on whether the brand is looking at pre-existing data or trying to forecast the future behavior of customers. Let’s discuss the two models.

Historical Customer Lifetime Value

Without considering whether or not a current customer would stay with the business, the historical model uses pre-existing data to estimate a customer's value. The average order value is employed to estimate the value of your customers. If most of your clients only contact your business over a limited time period, you will find this strategy extremely helpful.

However, this model has several limitations because client journeys can differ a lot. Customers who were once active and valued by the historical model can become inactive, which would give you misleading results.

Predictive Customer Lifetime Value

The predictive CLV model uses machine learning or regression to anticipate the purchasing patterns of both current and potential clients.

You may more accurately identify your most important customers, the product or service that generates the most revenue, and ways to increase customer retention by using the predictive model for customer lifetime value.

Let’s take an example that will help you understand the customer lifetime value formula.

A coffee shop is an ideal example for understanding CLV because it is simple to grasp even if you don't have much experience in the business. Let's assume that a regional chain of three coffee shops makes $5 in sales on average. The typical client is a local employee who comes in twice a week, 50 weeks a year, over five years on average.

Thus, the CLV would be $5 (average sale) x 100 (annual visits) x 5 (years)= $2500

How to increase the lifetime value of your customers

Now that we have discussed the different ways to measure your customers' lifetime value let’s see how we can increase CLV.

Redesign your onboarding process.

The process of introducing your customers to the brand’s product they purchased, including what you do, why it matters, and why they should stick around, is known as customer onboarding. In the first few days following a customer's initial purchase, they learn about your business and what you have to offer them.

Utilize the clients' information to offer carefully selected product recommendations or discounts. Then, follow up with email contacts to ensure that the products they have already purchased live up to their expectations. The reason why improved onboarding procedures are effective is that they create a foundation for ongoing client connections.

Introduce a referral program.

Referral programs represent an effective approach to raising the lifetime value of each customer. Research shows that referred customers have an 18% lower turnover rate and a 16% greater lifetime value. Additionally, 55% of people discuss their recent purchases on social media, and 81% of customers believe recommendations from people they know.

By providing a referral program, brands increase their CLV and access a pool of potential clients who may later become devoted ones.

Improve your customer service strategy.

90% of Americans claim that customer service is one criterion they consider when deciding which brands to do business with. Therefore, you should pay attention to your customer service and search for ways to improve it if you want to increase your client's lifetime value.

You can enhance your customer service by providing tailored services, omnichannel customer support, and a suitable return or refund policy to your current clients.

The better your customer service is, the more customers will feel appreciated by your brand for reasons other than their purchases. Customers will understand that quality and satisfaction, not overall sales volume, are you offer proactive customer care and you have strong return and refund procedures.

Focus on building long-lasting relationships.

The foundation of lasting customer relationships is trust. Customers will return if they think your business delivers the best deals on the products and services they need. But this is only the start. Customers expect more than just a business-based relationship.

Now that social media is an essential element of branding and marketing activities; customers want to develop a personal connection that makes them feel like more than just a path to improved business ROI.

Therefore, it's essential to interact with clients on your social media accounts in ways other than merely posting generic advertisements. For instance, your teams may initiate a dialogue about a topic that appeals to your target market, or you could use social media analytics to learn more about your clients and then post content that suits their preferences.

You need to stand out from the crowd for this to be effective. Fast and simple eCommerce is now standard; if you can establish a real relationship with your clients, you can keep them coming back and raise your overall CLV.

Proactively reach out to your customers.

Customers won't wait for your company to engage with them or provide information. According to recent survey results, 88% of customers want an email response in an hour or less. Businesses can implement procedures to speed up response times and facilitate simple connections, even though it isn't always practical to do so.

A prime example is active social media. Brands can speed up the connecting process and make consumers feel heard by giving a customer success team the resources and technology to track and address customer comments or issues via social media.

Relationships that demand a constant connection are now what drives CLV. One-hour email response times might be unachievable, but the more connected your customers feel to your company, the more likely they will return and spend more money.

Collect actionable feedback.

Listening is sometimes preferable to speaking. Customers frequently offer helpful suggestions on how you may adjust your operations to meet their demands better, and by implementing those suggestions, you can raise CLV.

For instance, you could design a poll asking your consumer base what they think about new product or service ideas. Don't restrict their options; instead, leave flexibility for them to offer new suggestions that might improve the situation. While not all consumers will participate, those who do frequently offer wise counsel may become some of your most devoted patrons.

This works because it demonstrates that you are ready to listen. Too many businesses believe they know what consumers want better than the consumers themselves, reducing overall CLV. Even if customers' advice isn't precisely what you want to hear, you may encourage long-term loyalty and increase CLV by taking the time to listen and answer.

Deliver targeted and personalized service.

According to 56% of digital marketers, email marketing is the best digital marketing strategy for retaining customers, but many companies fail to produce insightful content. They restrict themselves to automated campaigns without bringing any genuine value instead of offering valuable material.

Sending targeted and customized campaigns allow brands to concentrate on particular sections of clients and encourage their engagement with information specially made for them.

With Layerise you can create personalized and automated marketing campaigns for specific groups of your customers. We'll talk more about this later!

Create content to keep your customers engaged.

Content marketing will undoubtedly make your customers feel more connected to and involved with your brand if you do it well. You have many more opportunities to raise CLV and lower the cost of acquiring consumers when you publish content that focuses on the typical problems your customers face and educates leads to guide them into the sales funnel.

Customers who become emotionally attached to your brand will not only remain loyal to you for a more extended period but will also actively promote your brand on social media or through word-of-mouth. Once they are your biggest admirers, there is a good probability that they will buy from you more frequently as well. To achieve this, publish helpful, engaging, and advocating content.

How Layerise can help you increase the lifetime value

Brands can dramatically boost their customer lifetime value by using Layerise's solution. You can personalize the customer experience and maximize your marketing initiatives. You can also get in touch with your customers directly by email or text message to keep them satisfied and persuade them to keep buying from you.

Layerise also provides the fastest onboarding of new data for your clients. It helps you collect crucial customer data throughout the registration process. Based on the information that clients provide, Layerise automatically customizes their experience.

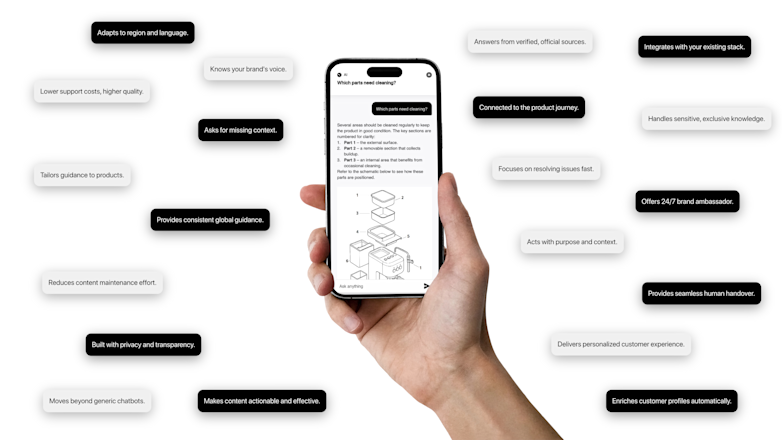

Additionally, Layerise helps you in educating customers on how to use your products. You can create product-specific Assistants with Layerise that are safe for your brand and that your customers can utilize to locate issues, assembly guidelines, or product onboarding information. Creating clear, creative, and helpful tutorials has never been easier.

To learn how Layerise can help your business, book a free demo now!

Learn how to collect valuable insights on your customers to sell even more.

How to Turn a New Obligation into a Growth with Layerise

A trusted, brand-safe AI assistant that knows your products, your customers and your content.